De-Dollarization: Will Supermacy of US Dollar is over

Now the world is moving towards de-dollarization. for many decades the dollar has remained like a king over other currencies. but today the dollar is gradually losting its dominance. We can definietly see that today the big economies of the world are looking for such an opportunity to trade in some other currency instead of dollar.

I don’t say that the dominance of the dollar is about to end, rather it is predicted that some other currency will soon replace the dollar in the global market. this is being belived because trade in other currencies has started in international market instead of dollar and people want to end the strengthning of the dollar and also want to replace the dollar with some other currency due to these reasons de-dollariztion has started.

America’s president Joe Biden somewhere is responsible for this de-Dollarization because the biggest mistake of the biden administrator is that they used their currency as a weapon and the way he imposes sanctions on Russia, it causes the value of the dollar to fall. this is because the dollar played a huge role in the global payment system, but when it was used for its own benefit, it resulted to down fall in the US dollar.

And that is why non-US investors are keeping their holdings in some other currency rather than in that dollar. one reason for de-dollarization is that when Russia – Ukrain war happened, America imposed some kind of sanctions on russia due to which russia is not able to trade in dollar because united state had prohibited Russia from using the SWIFT ( Society for Worldwibe Interbank Financial Communication) system. and then russia use other currency for trade. Trade has started as you can see that recently Russia has traded with india in indian ruppee.

Then after that, not only Russia but many other countries started trading in other currencies instead of dollars in bilateral payments. such as bangladesh, kazakhistan and Laos traded in yuan with china. and infact according to India news, India internationalized its ruppee and 35 countries showed their interest to trade in rupee specially United Arab Emirates.

The second reason for de-dollarization is technology, as you can see that many countries have developed new technology for payment methods, now their payment have become very secure and fast, like India’s UPI payment and E-Rupee. but it is not only india ad also some countries have strengthened their payment methods like Malaysia, Singapore, Thailand and Indonesia use some local currency to trade and Japan and Taiwan created a QR code system for payment method to trade each other.

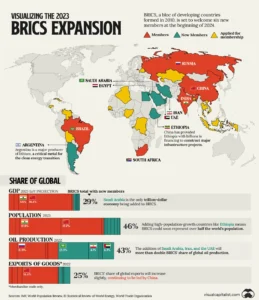

De-dollarization did not just stop here, this process has also started in the recently held BRICS summit which you will read about it further in below line.

How BRICS Has Accelerated De-Dollarization Initiatives

Before telling you that how BRICS accelerated the De-dollarization. but first you need to know that what is BRICS and which countries are include in the BRICS organization.

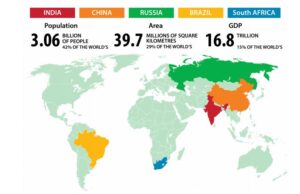

BRICS is an organization that brings together the world’s top non-western countries in which includes Brazil, Russia, India, China, South Africa, Argentina, Egypt, Ethopia, Iran, Saudi Arabia, and United Arab Emirates. The leaders of Brazil, Russia, India, China met in Russia first time after the financial crisis of 2008. but South Africa joined this organization in 2010 and remain 6 member are recently joined in BRICS on 1 january 2024 in 15th BRICS summit by announcing south african president Cyril Ramaphosa.

Leaving aside these six new countries which are joining recently in BRICS, if we look at the previous five old countries, they have 1/4th of the world’s land and 42% of the people live in these countries, they have a 24% of global GDP and 16% of world trade. Now you will know how important and powerful organization BRICS is and with the joining of other six countries, BRICS has become more pwerful.

Now we tell you how BRICS is becoming a accelerate of De-dollarization because by prediction that BRICS is going to bring its own new currency. according to report, that BRICS members are increasing their gold reserves. like India has increased its gold reserve by 3 tons, Russia by 31 tons and China by 102 tons. all these signals indicate that BRICS is preparing to introduce its own new currency and that too a currency which will be stronger than the dollar

To make a new currency successful, three things are needed which are :- Expansion – The expansion of that currency will happen when more countries join BRICS and then currency will expand in more countries. Acceptance – Acceptance will happen when more and more leaders of the country will recognize it. Trust – Trust means that when the value of that currency is linked to gold , then that currency will be reliable. and we see these three things happening gradually in BRICS which promote De-dollarization.

BRICS currency will be possible only when all the members of BRICS show their trust on new currency like example of the countries of Europe and also some non-Eurpean countries are traded with in one currency which is EURO while same as BRICS should also be on the same page that BRICS adopt only one currency for trade with BRICS members. and this will happen only when the dispute between India and China ends because India and China are the most popular and giant members of the Brics organisation.

But it is impossible to bring change in the dispute btween India and China because India and China are enemies of each other in every way. so, the possibility of BRICS creating a new currency seems very low. To more about BRICS click here

Is Ruppee Overtake the US Dollar

You might be wondering how the Indian Rupee will overtake the Dollar. First of all, let me tell you that during the de-dollarization movement the dollar is losting its strengthend ,there are many currency which are gradually going stronger then US dollar, among them, the Indian Rupee has a stronger prediction to overtaking the US dollar.

according to India’s global trade community said that to promote global trade, due to the increasing interest on Indian Rupees in global market, now Indian traders will do international trade in Indian Rupee at some countries. this step will taken on 11 january, 2022 by indian trade community.

The global leader is very concerned about the fall of dollar especially us and uk because most of the trade was done under SWIFT system and SWIFT system specially benefited US and European countries but now some countries are not doing trade with US dollar. And they are continuing to trade in another currency which is causing loss to western countries and the importance of US dollar is gradually decreasing. Before telling you why the country are intresting to trade in Indian Ruppee is increasing so much, first of all let us know what is SWIFT system?

SWIFT System – swift stands for Society for Worldwide Interbank Financial Telecommunication which was started in 1973 for Ways to improve cross border money transactions and that system is made by G10 countries. The importance of SWIFT is very powerfull scale of this system is so big that 50% of the world’s trade happens under this system. You will not believe that the daily transactions of SWIFT system are worth trillion of dollars and due to trustable and secure system, a total of 11000 banks in the world are connected to SWIFT.

So you can understand why Swift is so important. Now I am telling you how India encourage the De-dollarization, that RBI has created a system till the name of system is vostro account. India has created a Vostro account strategy which allows India to trade in other currencies instead of dollar. before the vostro system india using nostro system and to knowing the Vostro account first you know about nastro account.

What is Nostro account – nostro account basically use in foreign transaction and nostro is an latin word which means our money in your bank and this Nostro account means that a foreign bank tracks the domestic account of a country.

But Vostro account works exactly opposite to Nostro account and in vostro account Domestic Bank Tracks Foreign Bank Account. So by using vostro account, India can track the bank accounts of more and more countries and due to this strategy India is strengthening its rupee and from this to de-dollarization is accelrated by india.

With the help of vostro account, if an Indian trader has to make a payment to a foreign trader, he will make the payment to his domestic bank and then that bank will give the payment to the foreign trader’s foreign bank. So, you can see that to make global payments without using dollars, vostro account is a best to ignoring payment in US dollar. if any person in the world can trade or make payment in local currency by opening a Vostro account in India is helpful.

Now not only India is the only country which is skipping the SWIFT system while there are many other countries too which are skipping the SWIFT system like Russia’s SPFS system which came in 2014 and China’s CIPS system which came in 2015. This way you can understand how de-dollarization is happening.

Indian Rupee has joined the race to replace or de-dollarize the dollar. Indian rupee has joined the race to replace the US dollar or de-dollarization. I am saying so because a total of 18 countries have prepared to trade in INR, whose names are mentioned below.

- Russia

- Israel

- United kingdom

- Germany

- Myanmar

- Oman

- Sri Lanka

- Bhutan

- Singapore

- Indonesia

- Kenya

- Tanzania

- Mauritius

- Botswana

- Guyana

- Fiji

- Seychelles

- Uganda

In March 2023, Indian media reported that 18 countries were interested in bilateral trade with India and india is way to internationalise of his indian rupee. Central Bank of India i.e. RBI has given permission to do bilateral trading with these 18 nations. What’s more, India has already been doing bilateral trade in INR with some of its neighbouring countries such as Nepal and Bhutan.

So, this all the reason are giving signal that indian rupee will going stonger very soon and going internationalise in the world.

To Read more posts click here